Do we need ‘ESG-as-a-service’?

“Alongside the rise and rise of ESG and the data challenges every company will face, are the number of sectorial, regional, supra-regional, governmental, rating agency, and investment fund standards, principles and frameworks – each with their own set of criteria and measurements” – Lorraine Waters, Chief Data Officer, Solidatus.

ESG has quickly become a labour of love for many organisations around the world. The motivation to get this right stems from the desire to not only attract ESG-progressive investors, but to be a part of the global solution around environmental and social change – not be a part of the problem.

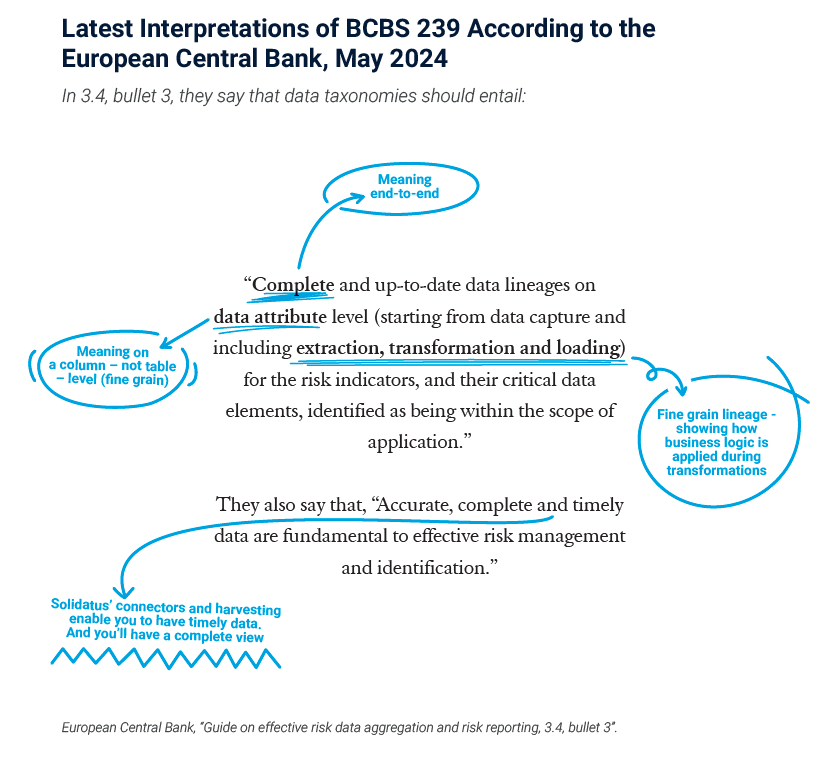

But the bubble of pressure this is creating for businesses and their CDOs, CTOs and CFOs is close to bursting. With lack of clarity around standards – given that there is no formal or official standardisation – and differing requirements from agency to agency, many are struggling to ascertain exactly what they need to do to become compliant before real and stringent regulations are enforced.

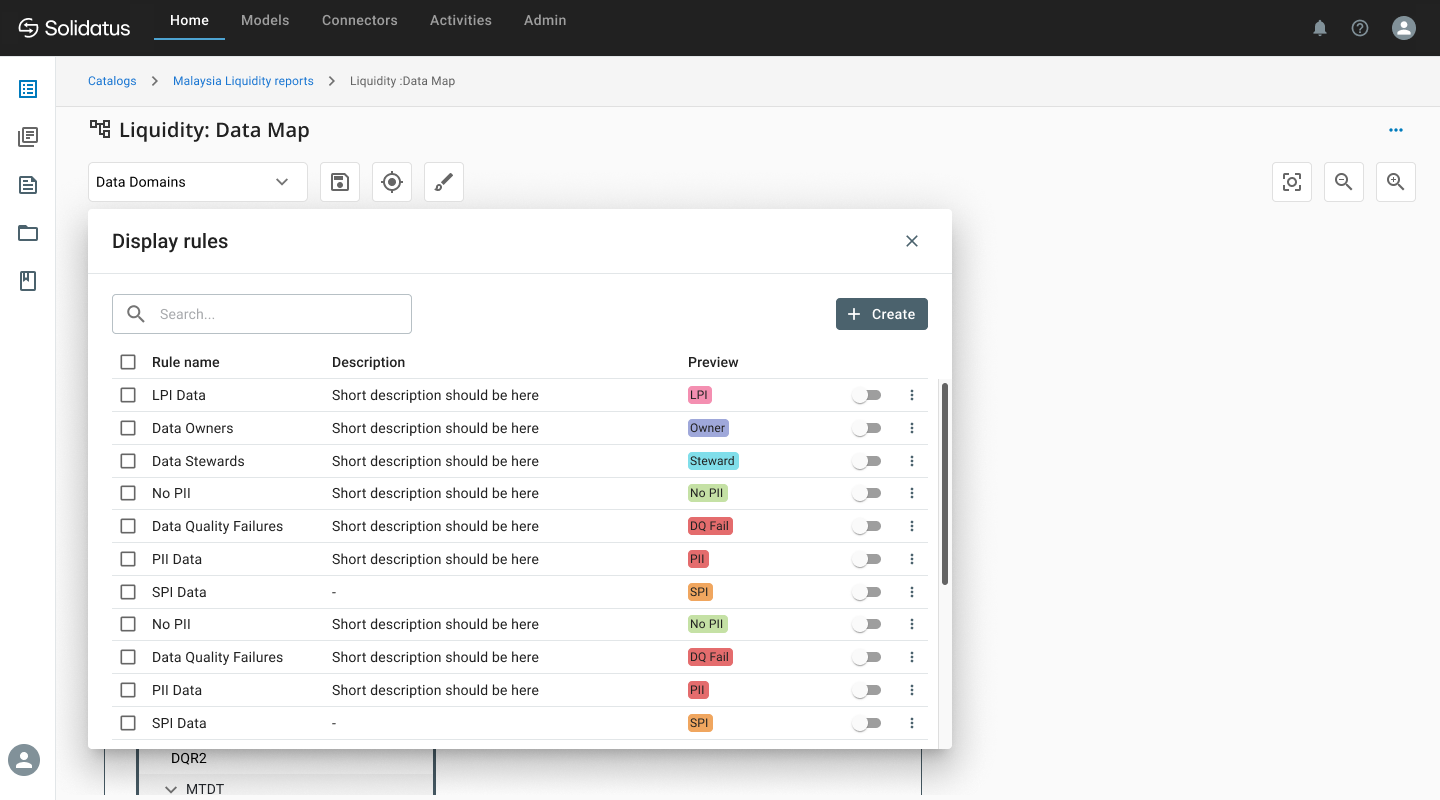

So the question is, how can organisations look at their data in relation to ESG in an effort to demystify its complexities? And what role can technology-based solutions like Solidatus play in enabling organisations to truly focus on making more sustainable steps forward, instead of being blinded by lack of consistency and standardisation?

Our CDO Lorraine Waters shares her insights around a potentially game-changing approach to ESG in her latest article for Finextra – Do we need ‘ESG-as-a-service’?: