Providing accurate, complete and timely data for BCBS239 compliance

Discover How to Stay Ahead in the Evolving Regulatory Landscape

Overview

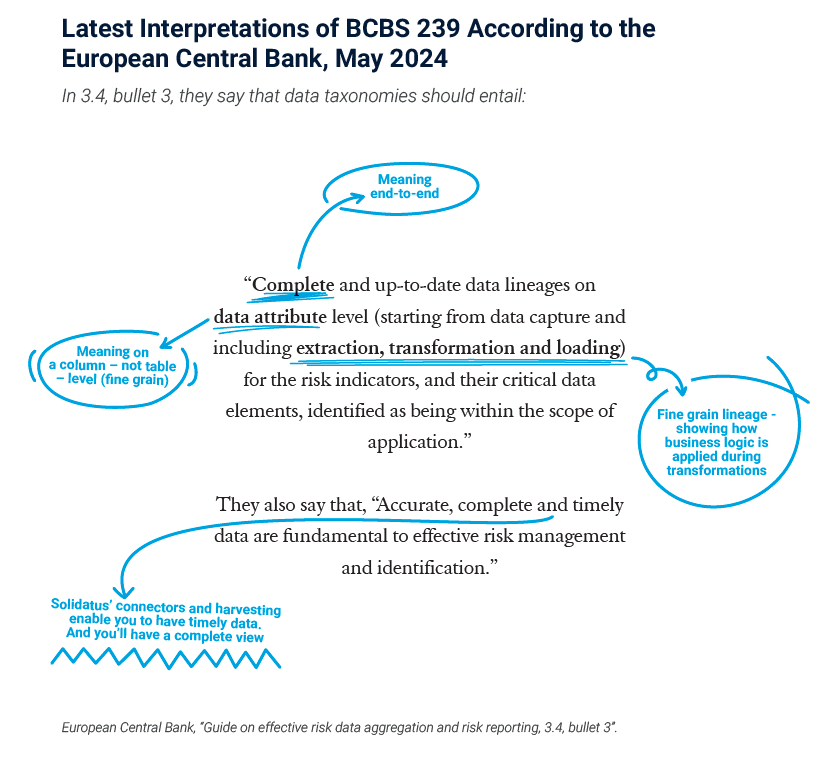

Navigating the stringent requirements of BCBS 239 can be challenging for banks operating in an increasingly complex data landscape. From ensuring a complete view of your data to managing granular traceability, the demands of regulatory compliance require more than just traditional tools. Solidatus empowers banks to meet BCBS 239 requirements efficiently, providing advanced data lineage and governance solutions tailored to ensure compliance while enabling strategic business insights.

What’s Inside the Whitepaper?

Discover how Solidatus simplifies BCBS 239 compliance, ensuring your organization meets regulatory demands and builds a stronger foundation for data governance. In this whitepaper, you’ll learn:

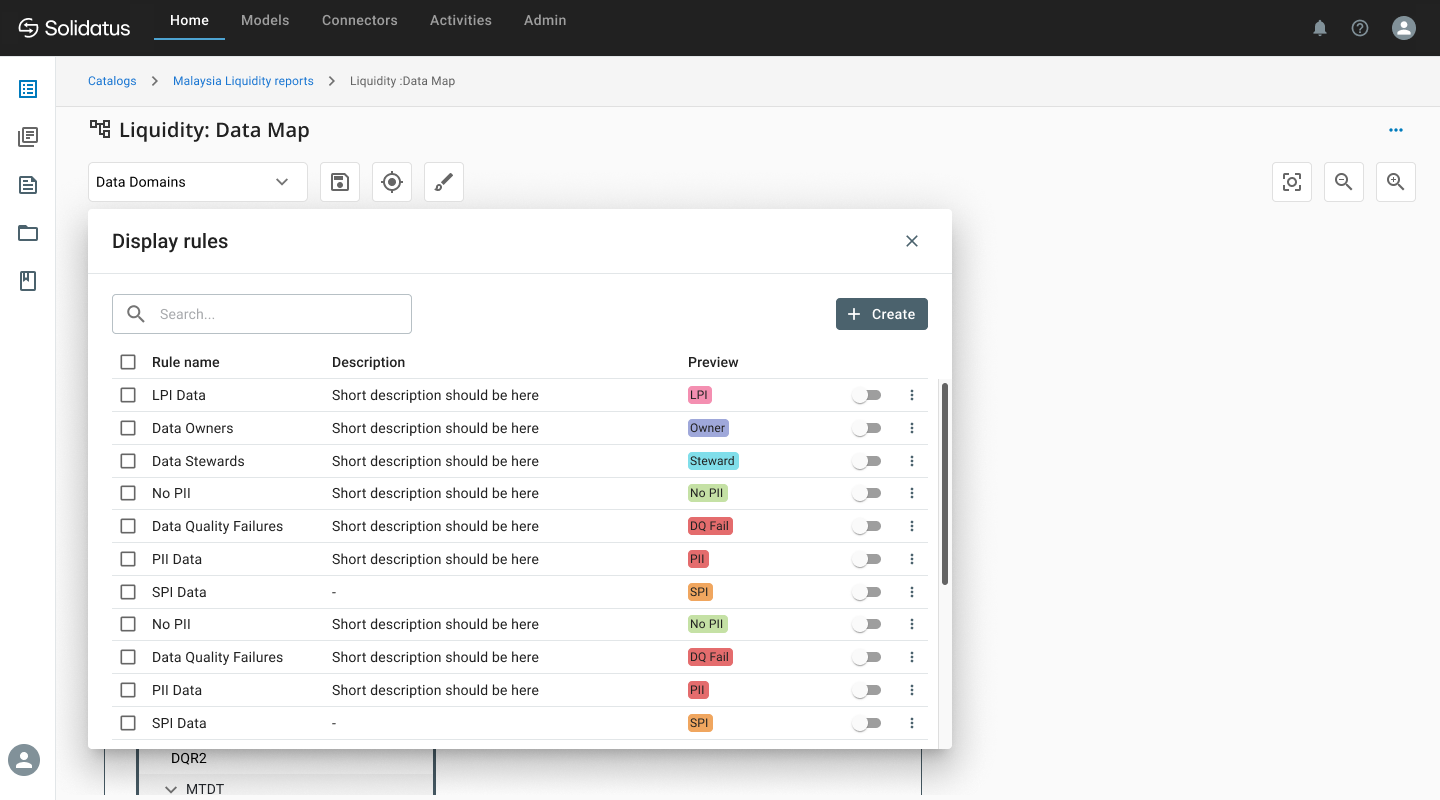

- Advance Data Lineage: Visualize end-to-end data flows across your organization to achieve the “complete” view mandated for BCBS 239 compliance.

- Granular Traceability: Drill down to attribute-level lineage for deep insights into data quality and transformations.

- Impact Analysis Made Simple: Identify and mitigate potential risks by understanding how data changes affect downstream systems and compliance reports.

- Streamlined Governance Integration: See how Solidatus works alongside data catalogs to deliver a unified approach to governance and compliance.

Download the Whitepaper Now!

Don’t let compliance challenges slow you down. Download our whitepaper to discover how Solidatus is helping leading banks like yours turn regulatory obligations into opportunities for operational excellence.

Access your content

Why Solidatus?

Solidatus provides a powerful, interactive platform that gives banks unmatched clarity and control over their data. Our solution helps you:

- Map and analyze data flows in real-time.

- Provide regulators with detailed, accurate lineage for compliance reporting.

- Proactively address risks related to data accuracy, security, and accountability.

- Build trust and confidence in data for both internal stakeholders and regulators.