Quantifying and combatting data distress

Senior global data leaders within banking and financial services firms are currently experiencing alarmingly high levels of data-related stress in the workplace, with 64% reporting that their data-related stress levels are sometimes or always high.

87% of those who reported any data-related stress, regardless of how often they feel it, say that it has affected their mental health and well-being, with 74% having taken sick days as a result, and 61% enduring an average of two to six nights of disrupted sleep per week.

And this anxiety has prompted 71% to consider quitting their jobs.

We call this phenomenon ‘data distress’, and these statistics are just a handful of the headline findings from new research recently commissioned by Solidatus.

The first major study of its kind, it involved 300 senior data leaders across the US and the UK in the financial services sector answering a series of questions on their levels of data-related stress and their views on the contributory factors.

Whitepaper

The assessment is bleak, and you can read about it in our whitepaper: Data Distress: Is the Data Office on the Brink of Breakdown? How US and UK Data Leaders in Banking and Financial Services are Facing Data Burnout. And the conversations we have day in, day out with practitioners – the ones that prompted us to commission this work in the first place – bear out our findings, so these will be very familiar pain points to people in our space.

But there’s hope; by quantifying it, as we do in the report, remedies have emerged.

Mistrust and the burden of regulations

So, what’s getting practitioners down?

A broad area we’ve defined as ‘data ambiguity and uncertainty’ appears to be the most significant cause of data-related stress, with 82% of respondents choosing at least one option from a range of answers that fall within this umbrella category.

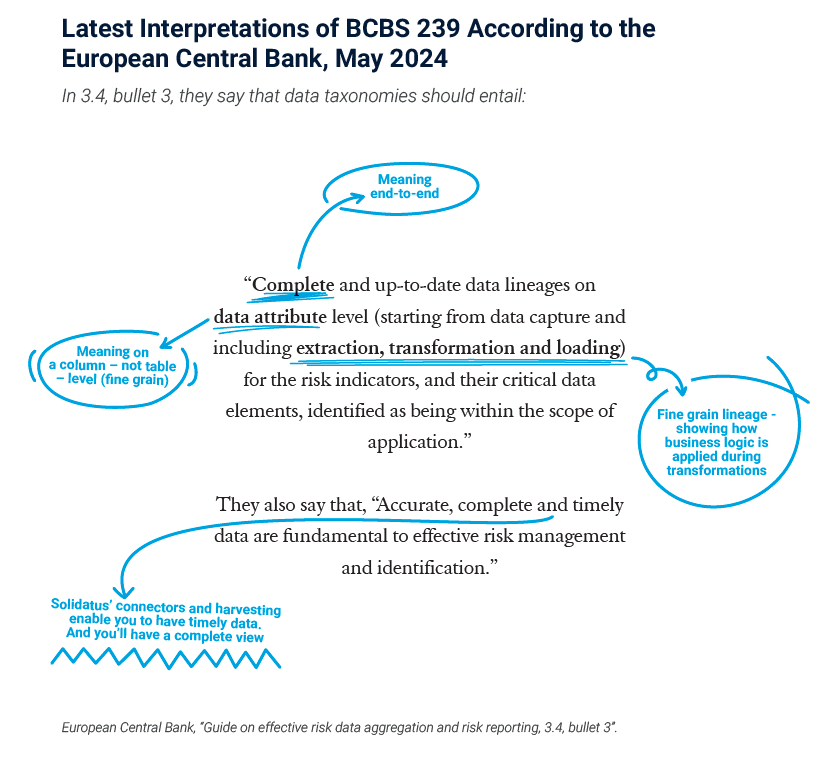

A particular source of frustration is how time-consuming and stressful managing data for financial regulations is. The most significant category of reason cited for why is one we designate ‘tech deficiencies’. 93% of respondents’ answers fell into this bucket, and this doesn’t just cause data distress; it’s a huge commercial distraction.

“With tactical firefighting and fine avoidance being the default, productivity and opportunity discovery will be stifled,” said Philip Dutton, CEO and founder of Solidatus, adding that with “global banking estimated to be worth around $20 trillion per year, even as little as a 5% drop in strategic activity due to data distress represents a $1 trillion reduction in value”.

Better tech and governance

In our report, we identify how the right tech stack and a better approach to data governance are both key to unlocking the cure for data distress, increasing trust in your data and generally increasing practitioners’ levels of happiness. By heeding the advice in the report, you can:

- Deliver data that you and your colleagues can trust and on which you can base decisions confidently;

- Reveal business opportunities that might otherwise have been obscured in the attempt to demonstrate compliance with suboptimal systems; and

- Reduce data distress.

Download the report to dig deeper into our quantitative research.

The Happy CDO Project

You’ll notice that we mention happiness above. We use this word more than in passing, as this research represents the first piece of activity in our The Happy CDO Project, a new initiative from Solidatus.

We’re shining a light on the issues that matter to data leaders to help them to be successful, fulfilled and happy in their work.

By focusing on their challenges, we can highlight solutions and strategies to help CDOs, data leaders and data practitioners to be their best.

We look forward to sharing more on this project with you in the months ahead.