A global wake-up call: Unpicking ESG

“The coronavirus pandemic has thrown a brighter spotlight on the Social aspect of ESG, with investors and society increasingly focused on how companies treat the entire organisational ecosystem, from employees and suppliers to shareholders alike. However, as the landscape continues to evolve and grow in popularity, it’s important to note that ESG isn’t necessarily as simple as it seems on the surface.”

ESG is here to stay and has rapidly become an important facet in the very fibre of an organisation. Not only is a good ESG programme essential to position a company’s principles and values around the environment and social governance, it is a highly desired criteria for investors. The lack of any ESG initiatives and regulations within a business can reduce its investment value.

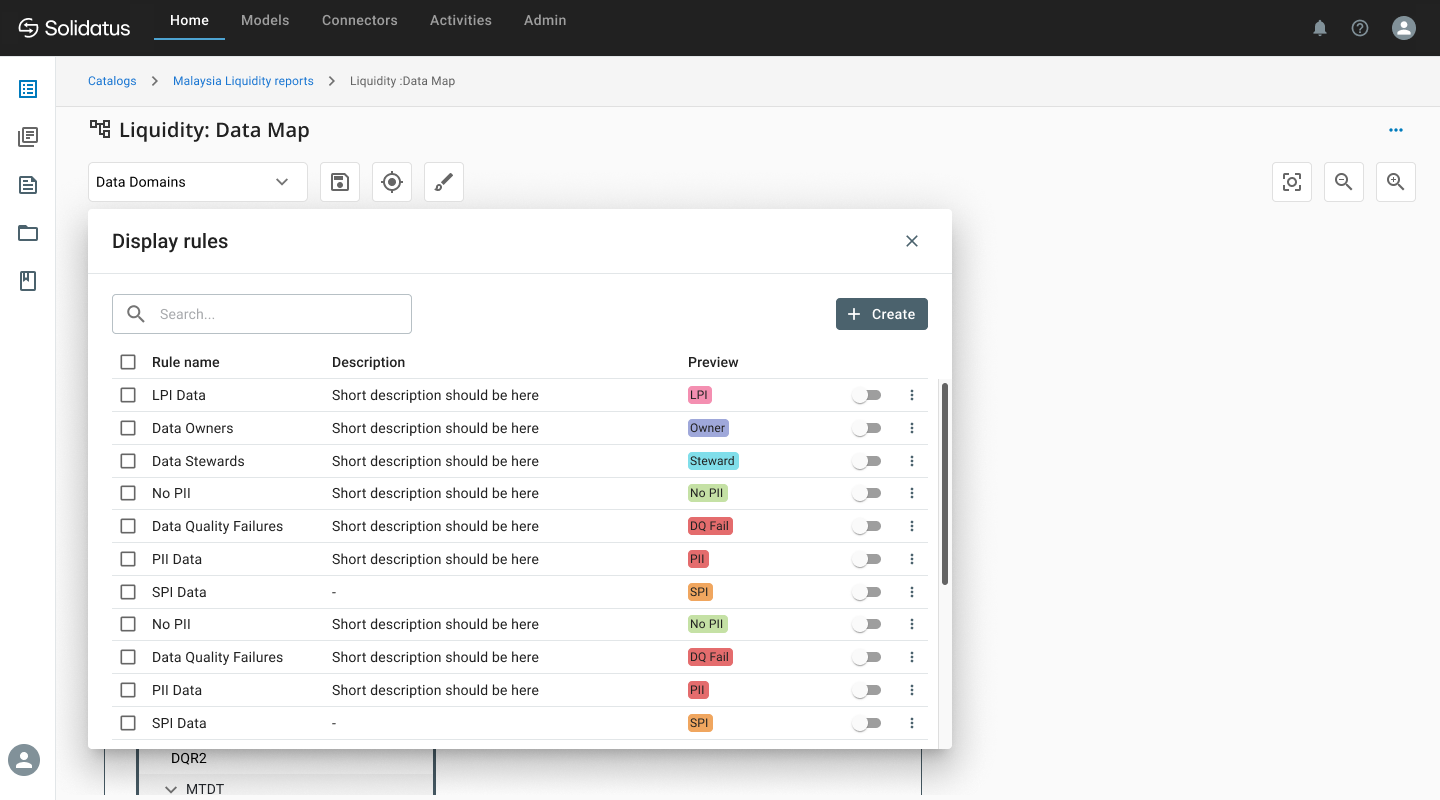

But ESG is moving and developing at lightning speed, despite many believing it would fade into the background behind the Covid-19 pandemic, as well as social and political unrest. This has led many to implement their own internal ESG rating systems, as well as seek guidance from an array of different ratings agencies.

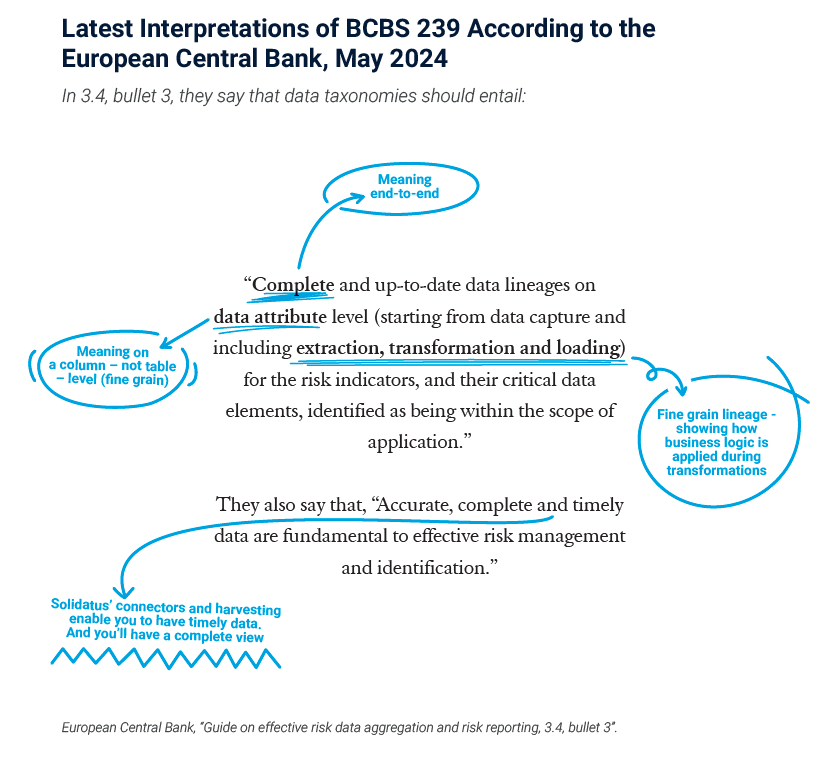

When we look at the criteria needed for ratings agencies against what is required for investing, ratings and scoring can vary wildly, creating a deep layer of complexity businesses must navigate through to achieve their desired ESG ideals. So how can organisations clarify these perceived complexities, particularly given the speed of which ESG is evolving?

Solidatus Data Architect and ESG specialist John Tobin caught up with the team at Asset Digest to discuss exactly why ESG can be such a complex landscape to work through, and how the right ESG programme solution and implementation can relieve businesses of this added pressure.

To find out more, read John’s article A global wake-up call: Unpicking the complexities of ESG :