FIMA report: Data as a strategic growth asset

Data Management: Lessons Learned

“Respondents to the FIMA 2021 report would be expected to ensure that the data for which they are responsible is fit for purpose. Answers to some of the questions, however, suggest that there may still be shortcomings…”

Containing survey answers from 100 Chief Data Officers from buy-side and sell-side firms across Europe, find out the challenges faced in 2021 and the solutions being put in place.

Some key findings from the report:

- 91% of respondents do not have a ‘high level of trust’ in the accuracy, traceability, and usability of their data across their enterprise.

- 51% of respondents answered that they use automation to identify data risks, but only 14% of answers included any knowledge of the processes involved.

Improved Decision-Making Through Trusted Data

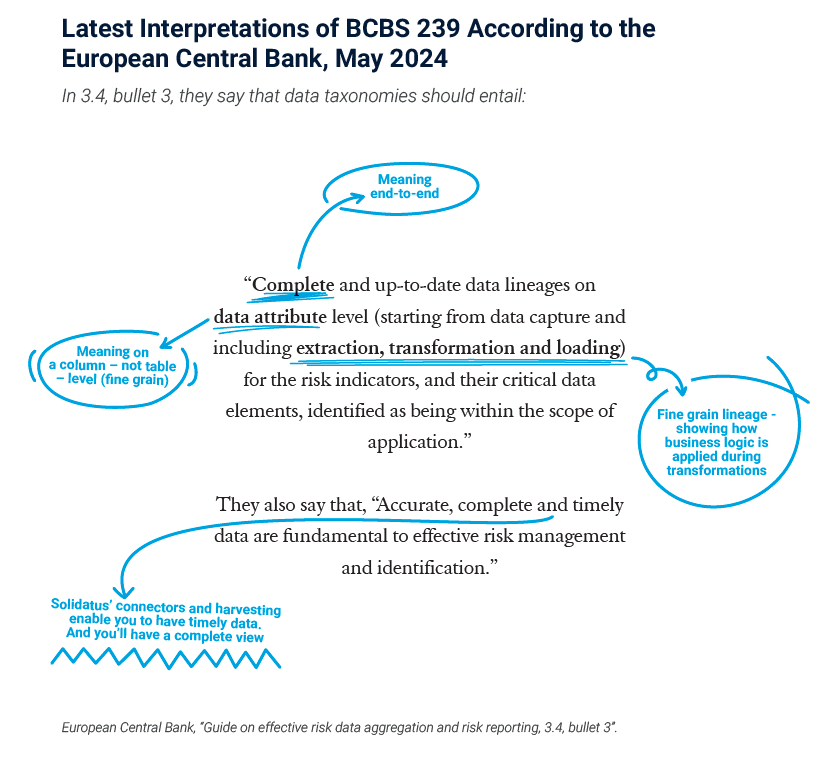

The regulatory landscape is still in a phase of adjustment. Risk portfolios are expanding to include less familiar challenges, such as personal data privacy, cloud usage, Environmental, Social, and Corporate Governance (ESG), and climate risk. As a result, firms are now placing more attention on the need to review controls of automation tools (e.g. supervision of robotic process automation (RPA)) and evaluating quality control of digital processes.

Today’s regulatory environment is in contrast to the past when regulators were responsible for identifying noncompliant behaviors and practices. It now places the onus on firms to transform their data analytics capabilities. This includes their ability to collect, store, and analyze data.

Today there are strong incentives for firms to transform how they manage risk compliantly and efficiently.

Success requires the replacement of legacy systems, automation of manual tasks, adoption of Cloud strategies (proprietary or otherwise) and integration of artificial intelligence and advanced machine learning techniques in core business processes.

Many firms are still on the journey in a process that is set to be transformational, not only in an operational sense but strategically too. When implemented in its entirety, big data will help firms go well beyond improving their risk management, reporting compliance, and operational efficiency. It will help them in devising better pre-and post-trading methodologies and improving the client experience, front-office sales and client retention.

Strong data management will be foundational. But it offers exciting opportunity – to gain insight, drive client value, and growth in revenues.

Download the free report to discover more insights.

Plus, don’t miss the thought leadership piece from Solidatus’ Co-CEO, Philip Dutton, on why what you don’t know can hurt you when it comes to automation.