ESG: Practical data strategies for meeting ESG obligations in financial services

With each passing month, the pace at which environmental, social and governance (ESG) principles are being addressed has been accelerating.

Download this whitepaper to find out about the ESG investing landscape, how to build a successful ESG program, and the benefits of a ‘lineage-first’ compliance solution.

The ESG investing landscape

Almost half the world’s assets under management involve a commitment to meeting climate change goals, according to pledges under the Net Zero Asset Managers initiative.

“The impact of ESG will be felt far and wide across the financial services community… The practical challenge is how to develop and implement an ESG strategy that is both effective and avoids box-ticking.”

Importance in organization-wide ESG understanding

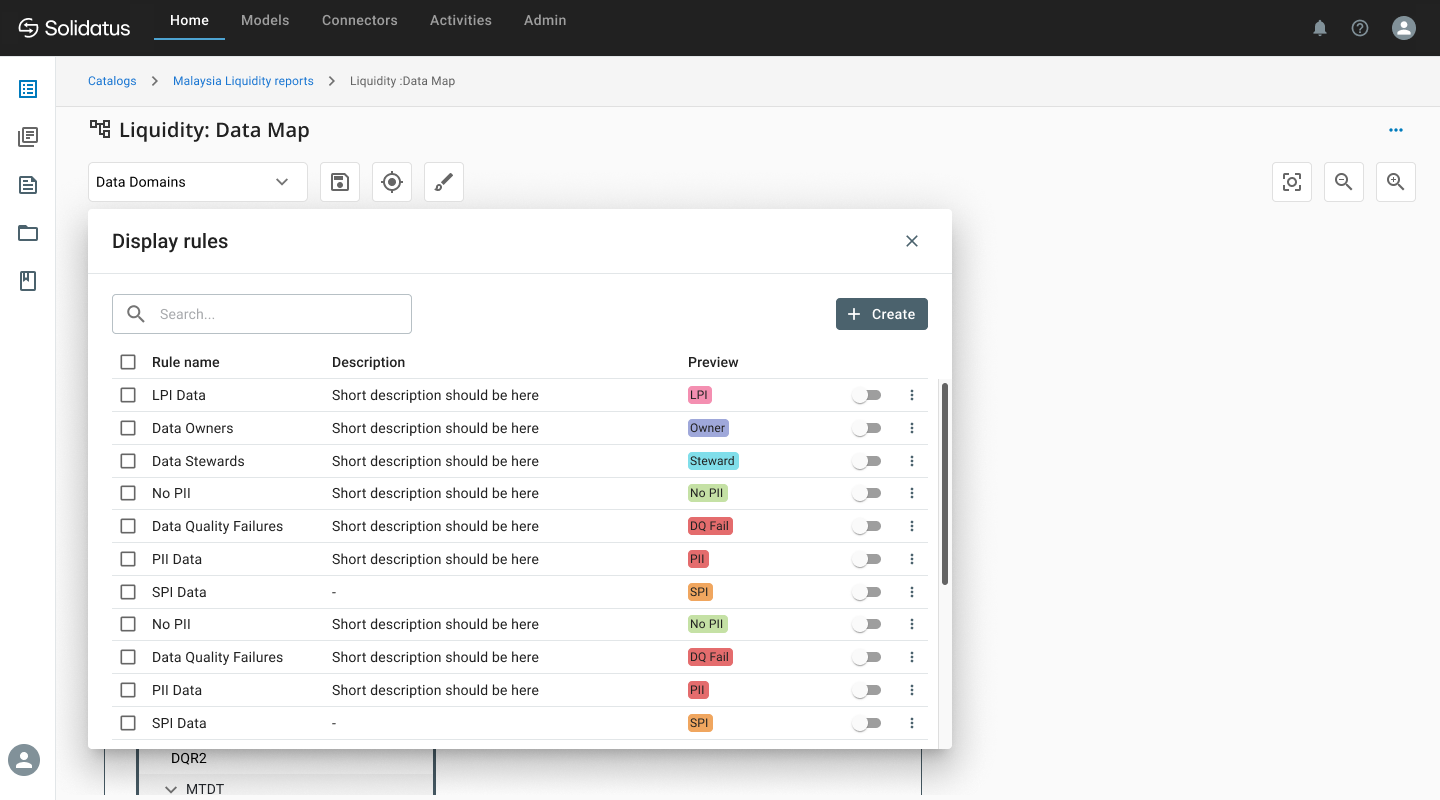

Best practice suggests the development of an internal framework for identifying people and teams responsible for meeting ESG obligations; interpretation of rules and regulations to define the obligation, and defining the deliverable to meet the obligation. The sophisticated integration capabilities of Solidatus can help with these challenges.

Building a successful ESG Program

Success in meeting ESG obligations depends on the ability to understand the data supply chain and how it intersects throughout the organization. Firms are finding that they are ill-equipped to gather the data they need, both to identify their obligations and to assign responsibility and resource to deliver on them.

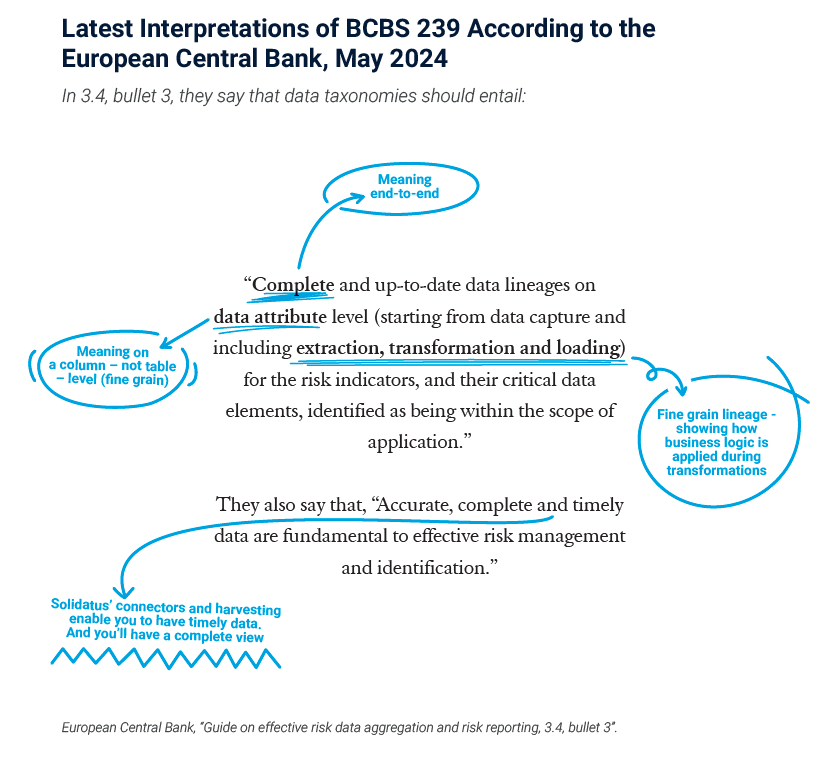

It is necessary to adopt strong governance and lineage disciplines to ensure regulatory obligations are mapped to appropriate data sources to ensure consistency and compliance. They also need to ensure flexibility to be prepared to meet regulations and reporting requirements as they evolve.

The benefits of a ‘lineage-first’ ESG solution

The ground-breaking lineage-first approach by Solidatus brings together ESG principles, company priorities, assessment methodologies and data sources and metrics to give a full end-to-end picture of the impact of ESG initiatives.

Solidatus brings ESG priorities, reporting and assessments together with the data flows, processes and their owners in a managed, sharable and maintained environment — meaning better governance, less waste, more efficiency and more effective socialisation of ESG programs.

Download the whitepaper to find out about:

- The ESG investing landscape and how best to respond to its major challenges

- Contextualizing ESG initiatives and establishing organization-wide understanding

- Building a successful ESG program and refining a data strategy

- The benefits of a ‘lineage-first’ compliance solution